Real Estate Data Visualizations of the Week - Nov 20

New data on housing inventory, Seniors impact on housing, International Debt Service Ratios, link between new housing production and apartment affordability.

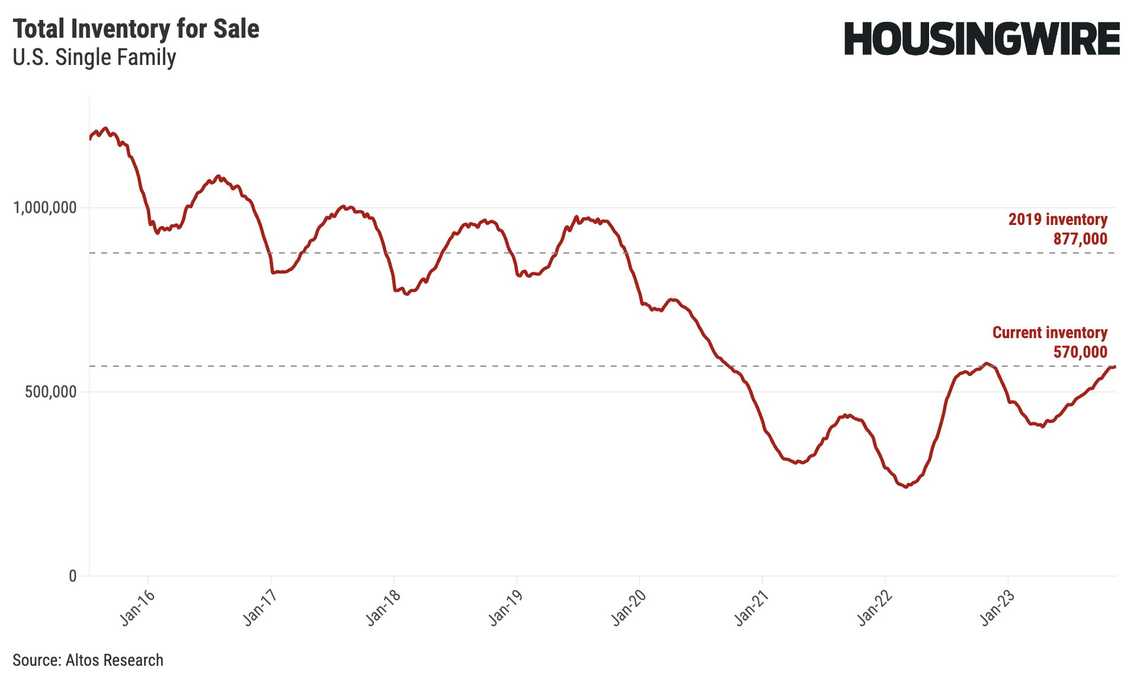

New data on a late seasonal surge in housing inventory was the big news this week in real estate:

Mike Simonsen shares his great insights with a new post. He states - Inventory of unsold homes is growing in November. That’s very unusual. Should we be worried? This week available inventory of unsold single family homes increased by 0.5%.

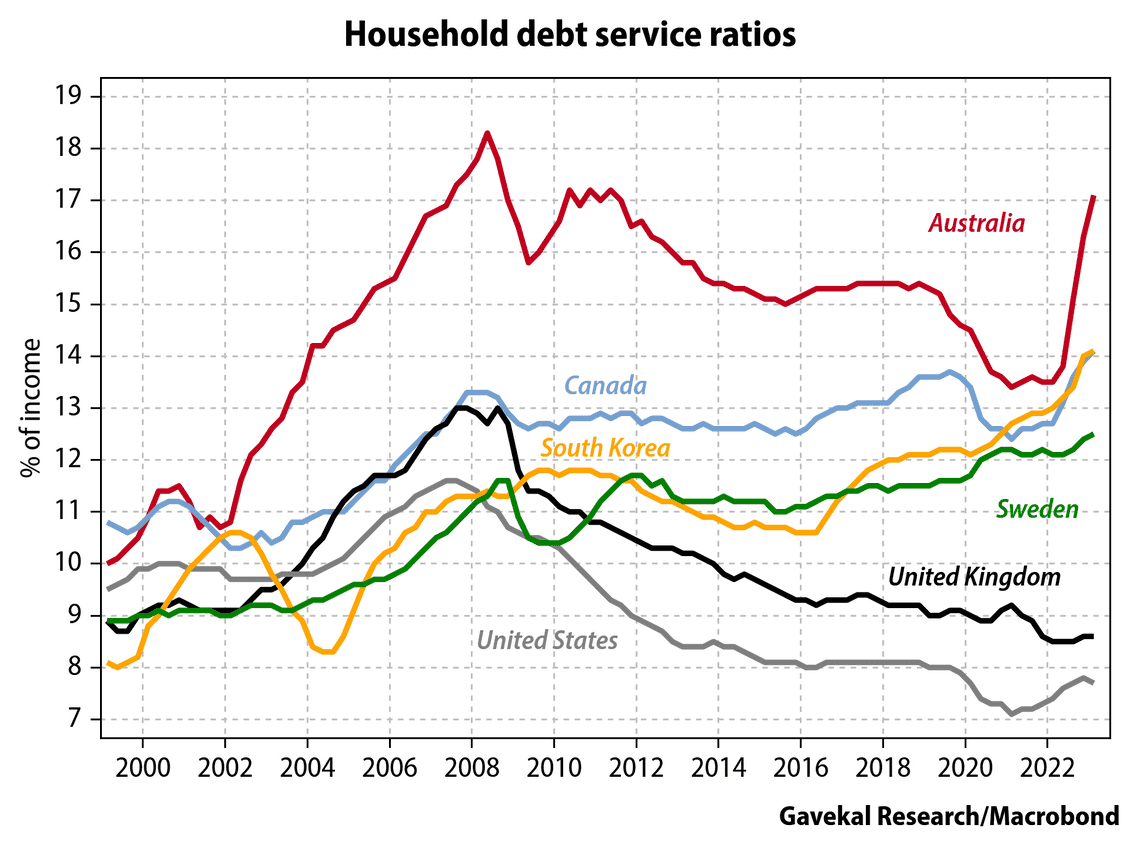

Gavekal produced an insightful chart on the debt to service ratios in a group of countries - including The United States, Canada, Sweden, Australia, South Korea, and the United Kingdom. The visual’s shocking point is how much debt Australians are servicing compared to their income. It’s 3% higher than any other listed country.

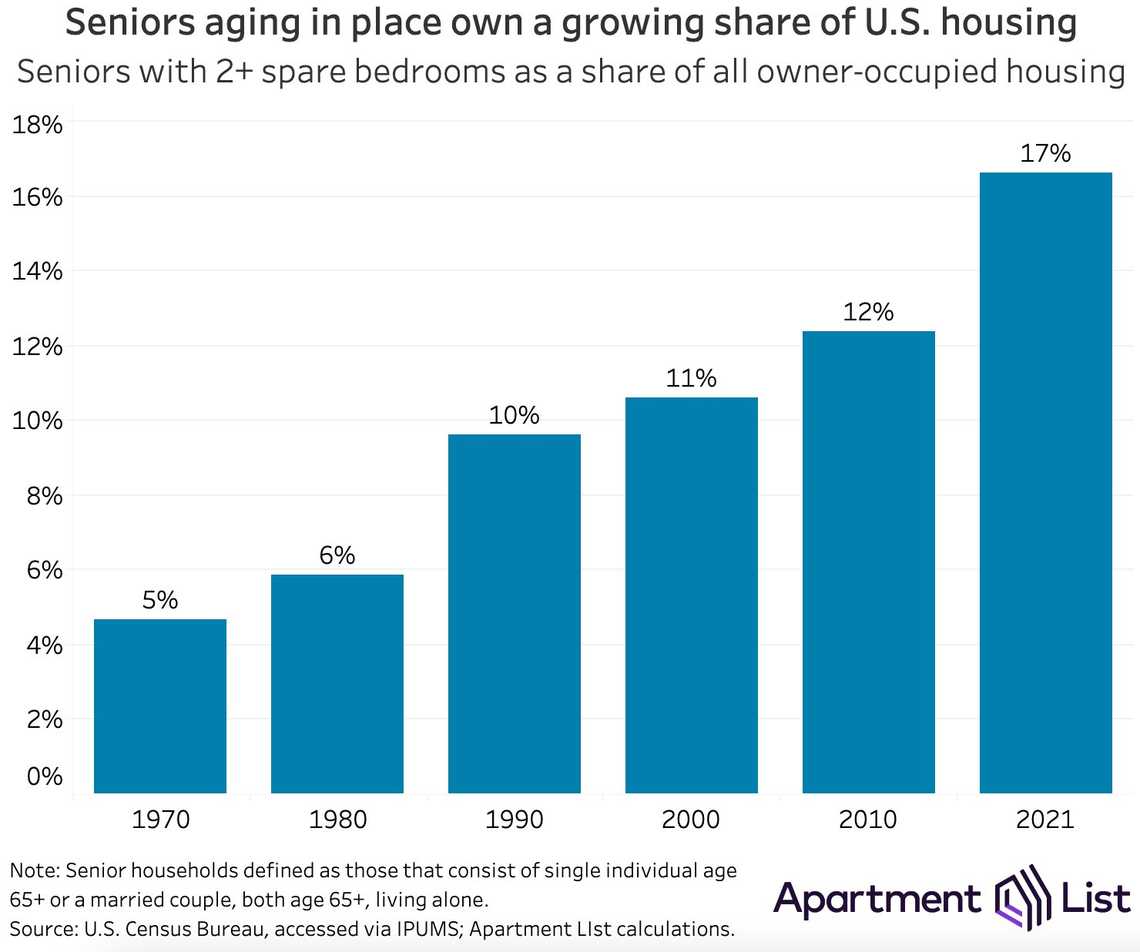

Chris Salviati writes a heavily researched article with great visuals on the effect seniors are having on the housing market. Staying in their houses later in age, record number of vacant bedrooms - all contribute to a shifting in housing supply staying off the open market.

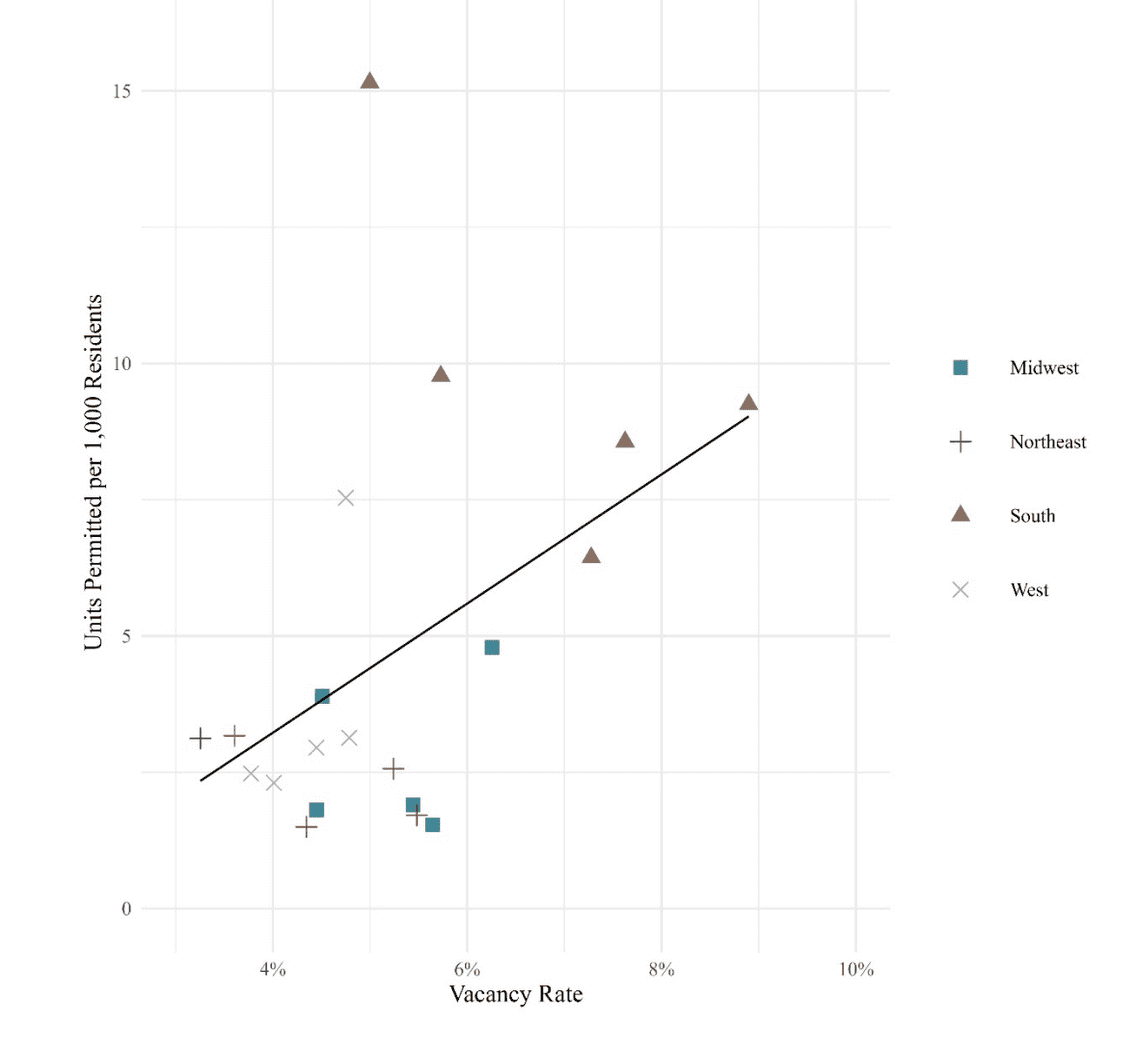

A team from New York University recently published a paper into the link between new housing production and apartment affordability. It points to new evidence that increased local housing building can slow rent growth in cities and free up more affordable vacant units in surrounding neighborhoods, without causing significant displacement.

Stew Langille