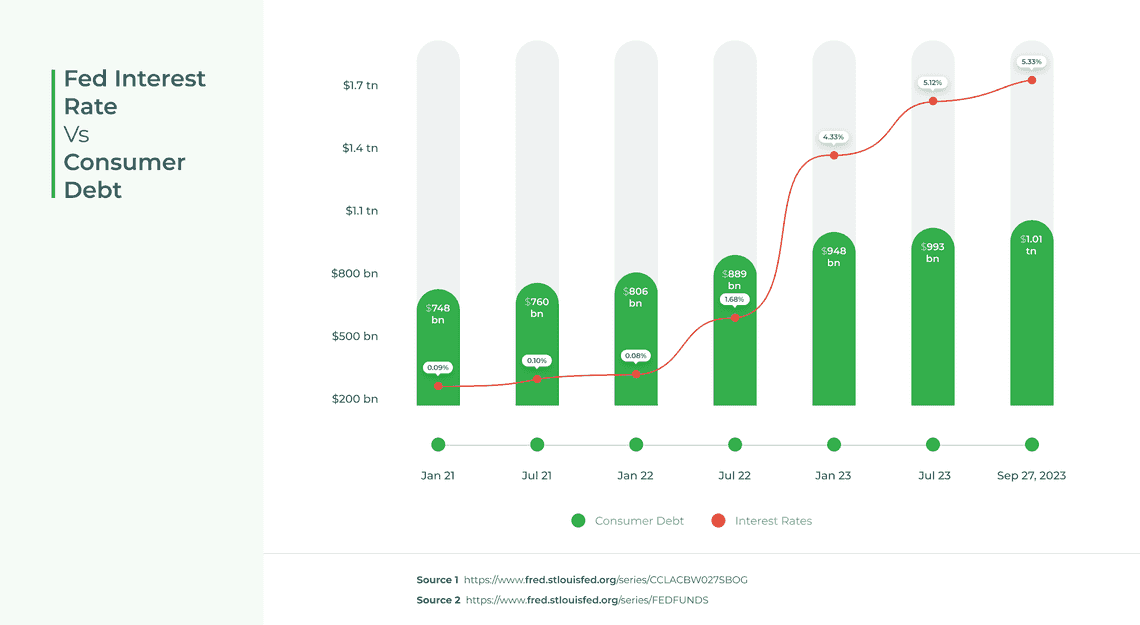

Fed Interest Rates Vs Consumer Debt - Oct 9 2023

US Consumer Debt levels continue to rise into Q4

Consumer debt levels were updated by the St Louis Federal Reserve on Sept 27. Total debt from American consumers continues to grow, even with the Fed Interest rates being held steady for the time being.

Fed logic for raising interest rates is partially to slow consumer spending levels. The fact that we are not seeing a slowing or reversal of total consumer debt points to either a delayed effect, or other factors contributing to debt growth. These other factors could be the burden on servicing higher interest rates levels on debt.

The relationship between consumer debt levels and interest rates is complex and can be affected by a number of other factors, such as economic growth, inflation, and unemployment. However; in general, low interest rates tend to lead to higher consumer debt levels, and high interest rates tend to lead to lower consumer debt levels.

Overall, the relationship between consumer debt levels and interest rates has historical trends, but both levels may continue to rise into 2024 due to the Covid economy, Fed Policy, and current consumer behaviour.

Stew Langille