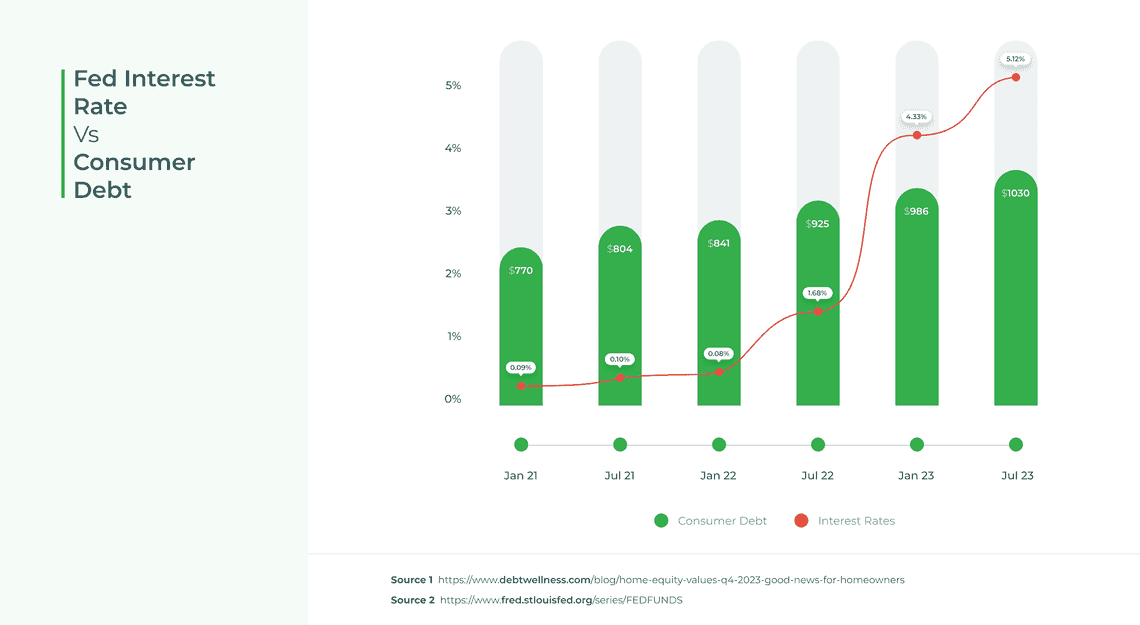

Consumer Debt Levels Vs Interest Rates

What is the relationship between consumer debt levels and interest rates in 2023?

Consumer debt levels and interest rates have both been rising throughout 2023. This raises the question whether these two have historically moved up and down together. If we look back, we see that consumer debt levels and interest rates actually have had a reciprocal relationship. When interest rates are low, consumers are more likely to borrow money, which can lead to higher debt levels. Conversely, when interest rates are high, consumers are less likely to borrow money, which can lead to lower debt levels.

Here are more detailed points on the relationship between consumer debt levels and interest rates:

- Low interest rates make borrowing money cheaper. When interest rates are low, the cost of borrowing money is lower. This makes it more attractive for consumers to borrow money to purchase goods and services, and to invest in their homes and businesses. As a result, consumer debt levels tend to increase when interest rates are low.

- High interest rates make borrowing money more expensive. When interest rates are high, the cost of borrowing money is higher. This makes it less attractive for consumers to borrow money, and can lead to a decrease in consumer debt levels.

- High consumer debt levels can put upward pressure on interest rates. When consumer debt levels are high, it can put upward pressure on interest rates. This is because lenders may charge higher interest rates to compensate for the increased risk of default.

- Rising interest rates can make it more difficult for consumers to repay their debts. When interest rates rise, the cost of servicing debt increases. This can make it more difficult for consumers to repay their debts, and can lead to an increase in defaults.

The relationship between consumer debt levels and interest rates is complex and can be affected by a number of other factors, such as economic growth, inflation, and unemployment. However, in general, low interest rates tend to lead to higher consumer debt levels, and high interest rates tend to lead to lower consumer debt levels.

It is important to note that the relationship between consumer debt levels and interest rates can vary depending on the type of debt. For example, consumers are more likely to borrow money to purchase a home when interest rates are low, but they may be less likely to borrow money to finance a vacation when interest rates are high. If this historical trends holds true, we may see further data into Q4 2023 and 2024 that points to a decrease in discretionary spending and credit card usage for vacations, holiday shopping, and home appliance purchases.

Overall, the relationship between consumer debt levels and interest rates has historical trends, but both levels may continue to rise into 2024 due to the Covid economy, Fed Policy, and current consumer behaviour. Consumers should carefully consider their debt levels and current interest rates when making financial plans for 2024. Debt is potentially huge life stress. Effectively managing and balancing debt with assets like home equity is key to achieving financial wellness.

- Stew Langille

- @slangille