Our Mission

Improve every American's financial situation

We realized people were losing billions of dollars to mortgage lenders that were only focusing on interest rates.

The smart loan was created to help people stop losing money and own their financial future.

Our Investors

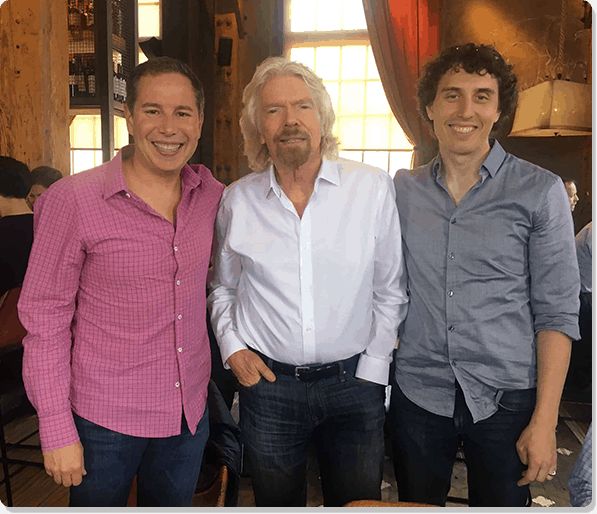

I love to invest in companies that make people's lives better and LoanSnap is exactly that. Its technology allows consumers to take control of their financial lives and will shake up the mortgage market. The strong founding team combined with its tech and a dedication to helping consumers will be a winning formula.

Sir Richard Branson

Founder at Richard Branson's Virgin Group

Our Culture

We're a group of hard-working and passionate engineers, marketers, designers, and product managers. We care about our work and each other.

Come help us change the mortgage lending experience!

Join Us